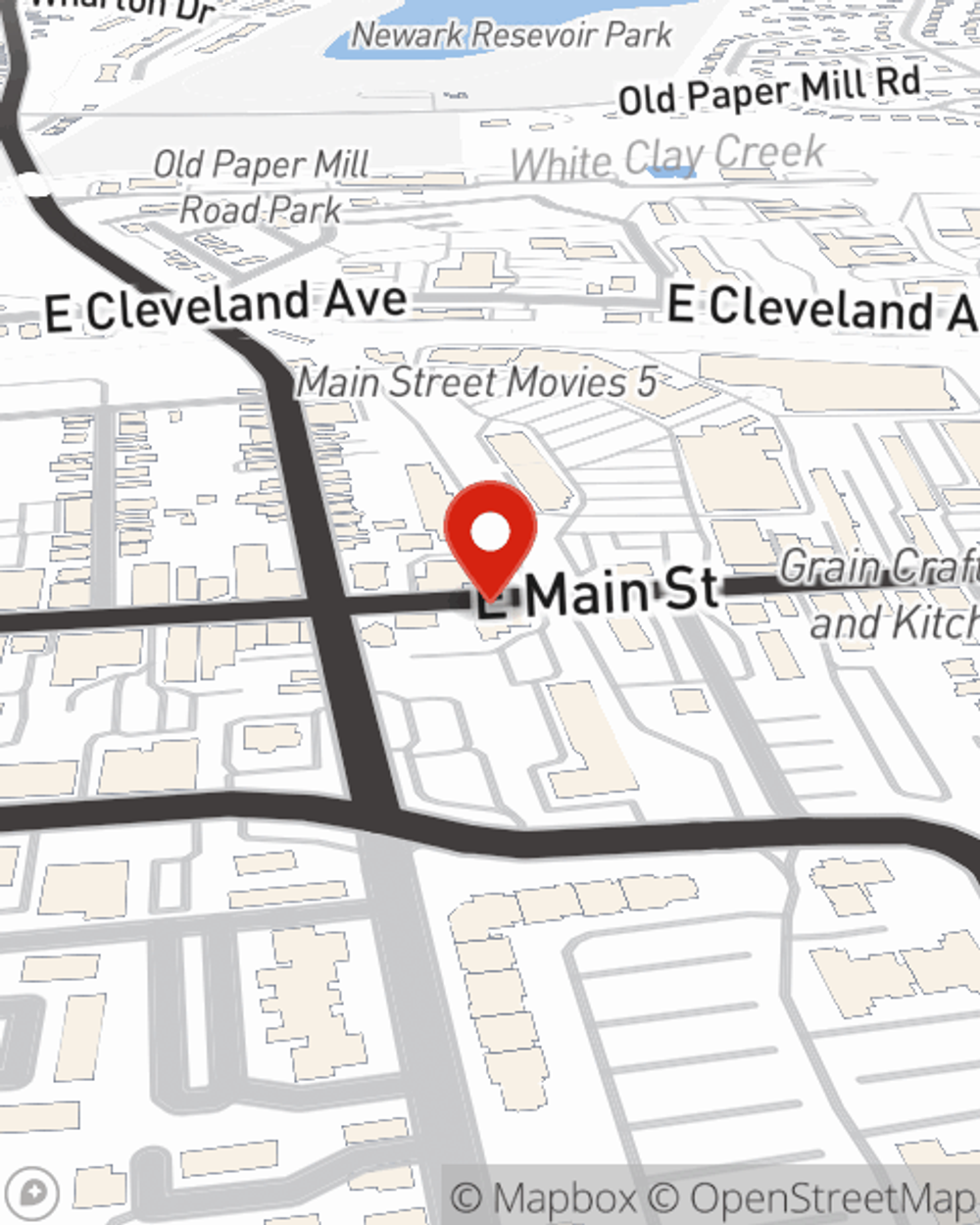

Business Insurance in and around Newark

Researching insurance for your business? Search no further than State Farm agent John Kater!

Helping insure businesses can be the neighborly thing to do

Help Prepare Your Business For The Unexpected.

Small business owners like you have a lot of responsibility. From product developer to marketing guru, you do as much as possible each day to make your business a success. Are you a physician, a real estate agent or a locksmith? Do you own a cosmetic store, a donut shop or a vet hospital? Whatever you do, State Farm may have small business insurance to cover it.

Researching insurance for your business? Search no further than State Farm agent John Kater!

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

When one is as committed to their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for commercial liability umbrella policies, business owners policies, artisan and service contractors, and more.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent John Kater's team to explore the options specifically available to you!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

John Kater

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.